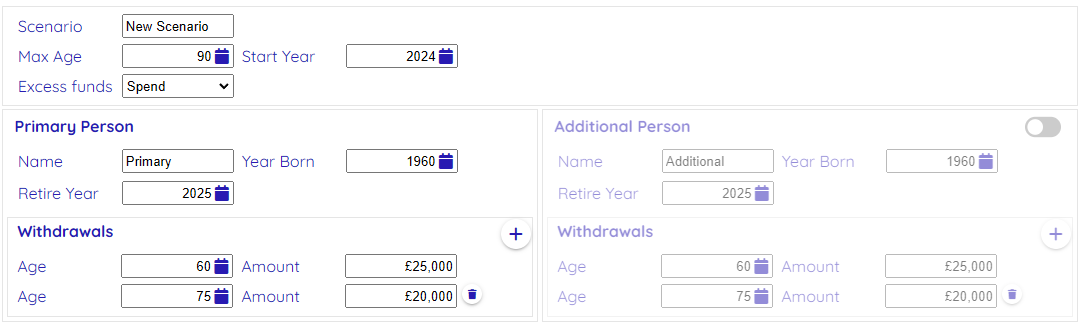

The top section of the Configuration screen contains information about the scenario name, when it starts, how long it will run for and required withdrawal amounts.

The Max Age refers to the age of the Primary Person that the scenario will calculate up to and the Start Year is the year from which calculations start. The Start Year can be before when the first withdrawals are made, this will allow for investments to grow leading up to your retirement age.

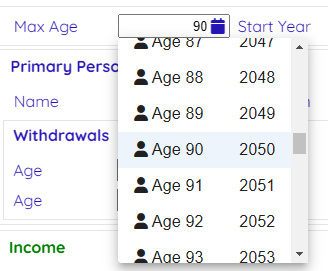

When using an age or date drop down you will see that both age and year are displayed. Depending on the context of the selection you are making one will be more useful than the other, so both are provided.

In the case that you have more income that required withdrawals you we have ‘excess funds’ for that year. You can select whether to keep these funds as additional spending money, or to reinvest them, using the ‘Excess funds’ dropdown. If you select to reinvest the funds they will be added to the first ‘Investment’ that you have.

Incomes, Investments and Costs can be assigned to the Primary or Additional person. Dates and ages for these relate to the person that they are assigned to,

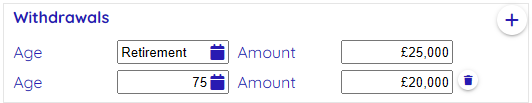

The anticipated Retirement Age can be set, and this can then be used when selecting Age or Date subsequently.

Withdrawals

The amount of money that each person needs to withdraw per year is configured here.

Typically a person spends more in retirement when they are younger, so you will probably want to reduce expected withdrawals as age increases. A general rule of thumb is that at age 75 you will need 25% less than when you first retire.

Additional rows can be added to the Withdrawals configuration using the ‘+’ button, and rows can be deleted using the trash can button at the end of that row.

Additional Person

The Additional Person is inactive by default. You can enable this person by clicking on the toggle in the top right of their configuration section.