You can specify rules for any of your Incomes or Investments in order to fine tune how your withdrawals are done. This gives you the ability to specify how much or how little you drawn down from a particular investment depending on how it has performed, or by date. You can also set up rules to add funds to investments.

Let’s look at some examples.

The Basics

In common with other areas of the Finance Calculator, you can add rules using the ‘+’ button, and delete them using the trashcan. They can also be enabled and disabled using the switch to the left side of the row.

Set Up State Pension

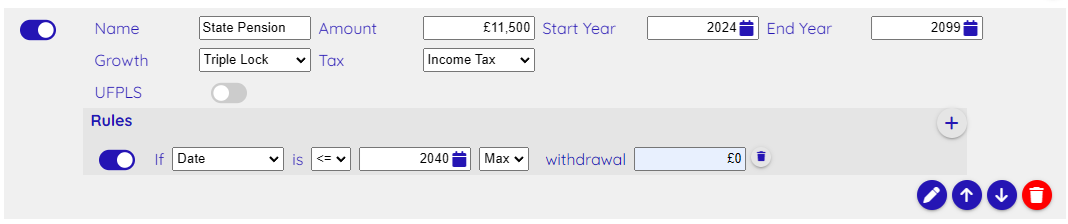

Let’s assume that you are 50 now, but you want to enter the UK State Pension into your scenario. We know that in 2024 the state pension currently pays out £11,500 and will increase by the Triple Lock annually. We want to set up this income so that it is part of the scenario from now, and will gain the expected increases afforded by the Triple Lock, but we can’t actually take it until we are 67.

Here you can see that the State Pension is part of our scenario and is active from 2024. It will increase by the Triple Lock annually and is eligible for Income Tax.

We have added a rule which says that if the date is 2040 or earlier, i.e. when the person is 66 years old or under, we have specified that the maximum amount which can be taken is £0. In other words we will start to draw from the State Pension from 2041, or age 67, and after.

Multiple Rules

You can set up multiple rules for each investment. The calculation will then find all applicable rules and, when determining withdrawals, take the most restrictive one into account.

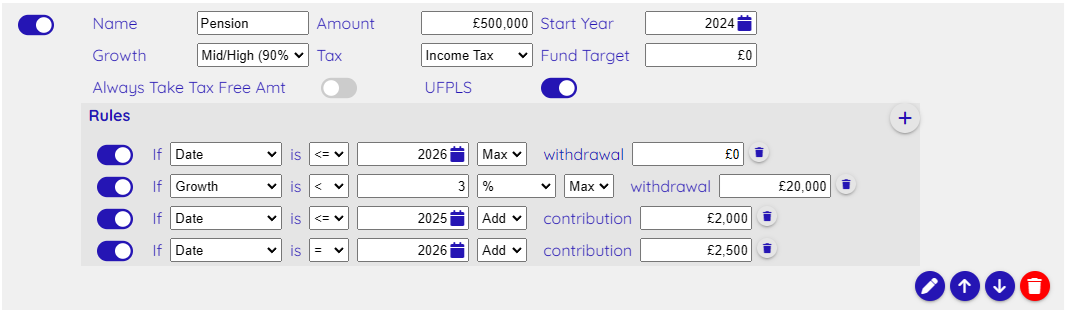

Here is an example where we have a pension which we want to start drawing down from in 2027, but up to then we will still be making contributions. In 2024 and 2025 we’ll add £2,000 and in 2026 we’ll add £2,500. From 2027 we will start to make withdrawals, but if the annual growth rate is under 3% we will limit the amount taken to £20,000 for that year.

Available Options

Rules can be based on:

- Balance – i.e. the current balance of the investment

- Date

- Growth – either by and absolute amount or a percentage

The outcome of a matching rule can then be:

- Min – the minimum amount of withdrawal for this investment

- Max – the maximum amount of withdrawal for this investment

- Add – the amount to add to the current balance of this investment

- Growth – override the growth type of this investment