Inflation

All figured entered should be in today’s money, the tool takes care of inflation.

The Significance of Order

The order of the rows is important as this affects the calculation. In general the calculation does the following:

- Take withdrawals and add them to any active costs to get total amount needed for the year

- Take all Income

- Working from the top row of investments and going down withdraw funds to reach the desired annual withdrawal

The order that investments are drawn down from can make a large impact on the success of the plan. This ordering, in conjunction with the ability to set Fund Targets allows for multi-pot strategies to help mitigate risk.

Fund Targets

If you set a Fund Target for an investment then at the end of the processing for the year the calculation engine will try to take funds from other investments to ensure that the funds in that investment are always at least as much as the Fund Target.

The theory behind this is that you can use this in conjunction with setting a rule on a more risky investment such that it will not need to withdraw funds when the market is going through a period of negative growth.

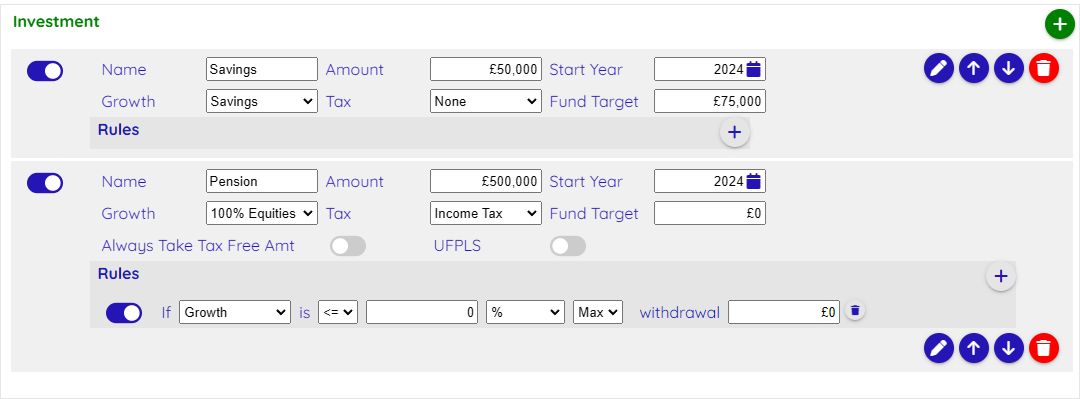

For example with the following setup the withdrawal rate is £25,000 per year, so the Savings investment is set to maintain at least 3 years worth of withdrawals. If the 100% Equities pension has a bad year its rule prevents funds being taken from it, which stops it from topping up the Savings investment to the Fund Target level. When the Pension recovers it can then top up the Savings account again.

Rebalancing

Investments are rebalanced as the final part of processing for a year, and this is where funds are moved from one investment to another in order to satisfy Fund Target values.

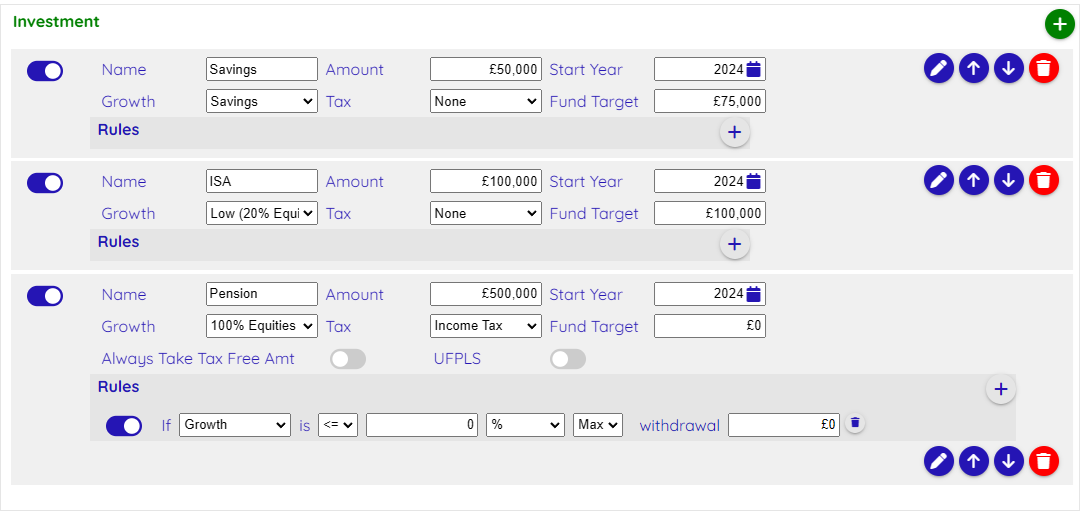

This process works top down so in the following example the Savings investment would attempt to take funds from the ISA and then, if it still needed more funds, from the Pension. After that the ISA investment would attempt to take funds from the Pension.

An investment will not provide money to achieve a Fund Target if it does not have enough funds itself, or if a Rule prevents it from doing so.

Rules

Rules can be set up to add a level of sophistication to your withdrawal strategy. It is likely that a lot of the rules that you set up will not be triggered by running a standard Projection, so you will need to test out their effectiveness by running them through the Modelling facility.