Finance Calculator is a tool which helps you to plan your financial future. You can set up different scenarios reflecting where you are, or where you want to be, and then visualise how they would play out over time. For a more rigorous test of your plans you can model how your scenarios would have performed against historic stock market and bonds returns data.

The tools is free to use, although you are welcome make a donation towards its hosting and maintenance costs.

Inflation

All figured entered should be in today’s money, the tool takes care of inflation.

Creating an Account

First go to the Finance Calculator Website and click on ‘Create User’.

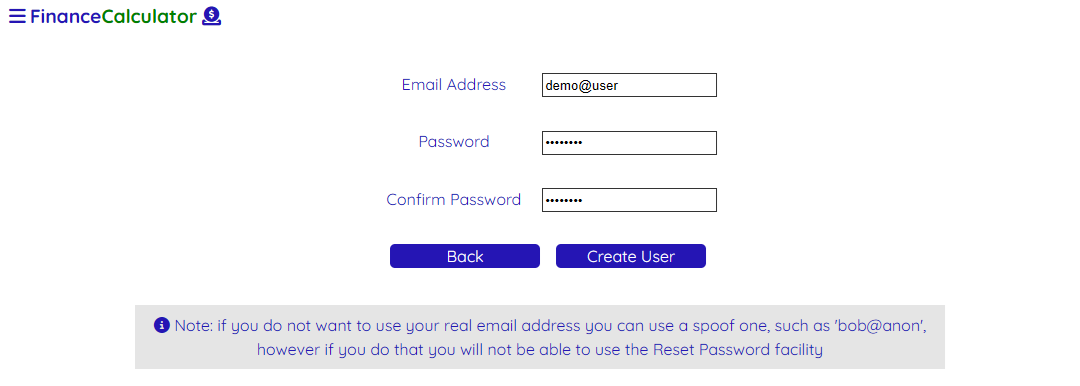

Then enter your user credentials. The tool will warn you if you try to use a name which has already been used, and your password must be at least 8 characters long. An email address is used for your username as this allows for forgotten passwords to be reset, however you can spoof an email address by simply putting an ‘@’ in your name if you would prefer to remain anonymous.

Scenarios

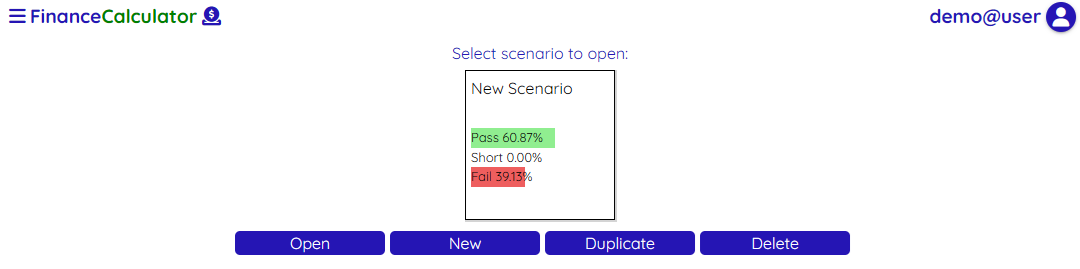

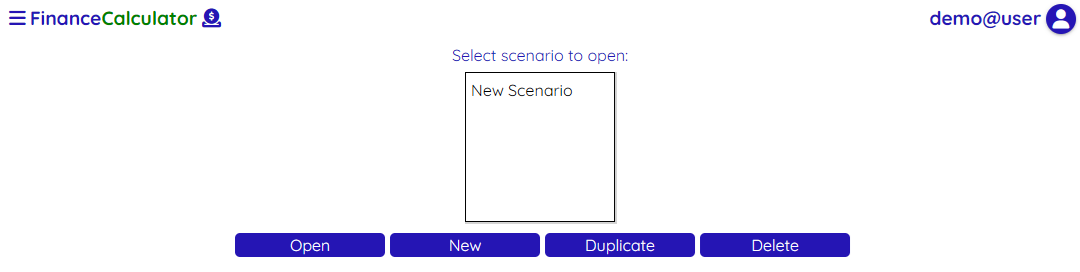

Once you are logged in you will see all of your available scenarios. A new account will have a default scenario created for you to experiment with, you can either double-click this or select it then click ‘Open’.

Scenario Configuration

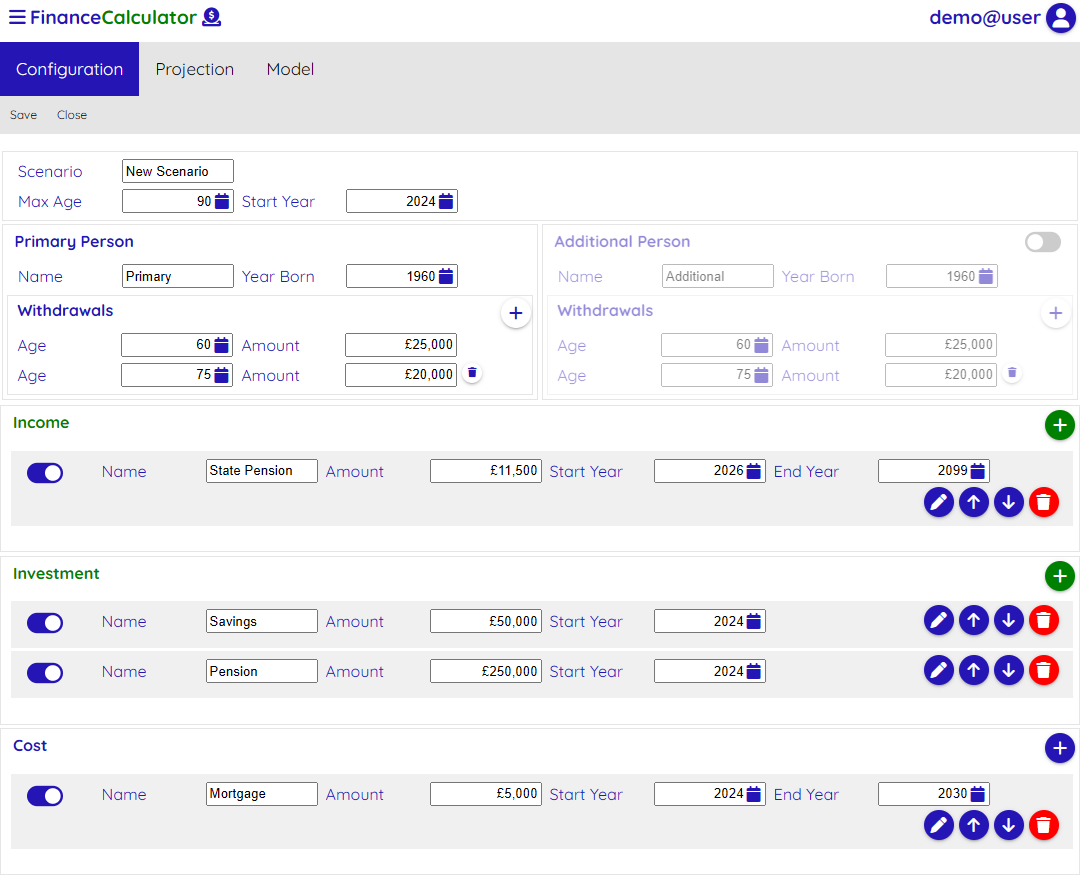

A scenario consists of four sections:

- Details of the person, or people, who this scenario is about.

- Any income sources to be included, such as defined benefits like the state pension or a final salary pension as well as income you might have from a rental property.

- Investments, such as private pensions or ISAs.

- Costs, either one off or recurring. Perhaps you want to plan a big holiday, or you want to help your children get on the property ladder by paying their deposit. Or you could have regular payments on a car or have payments left on your mortgage.

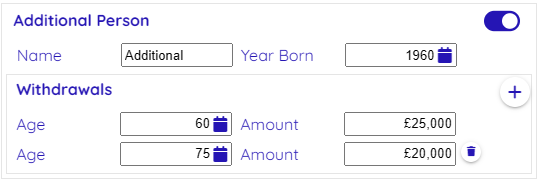

This is a simple scenario where the ‘Additional Person’ is not included, but you can enable them by clicking on the toggle in the top right of their configuration box.

For more information on how to configure your scenario see the Scenario Configuration Guide.

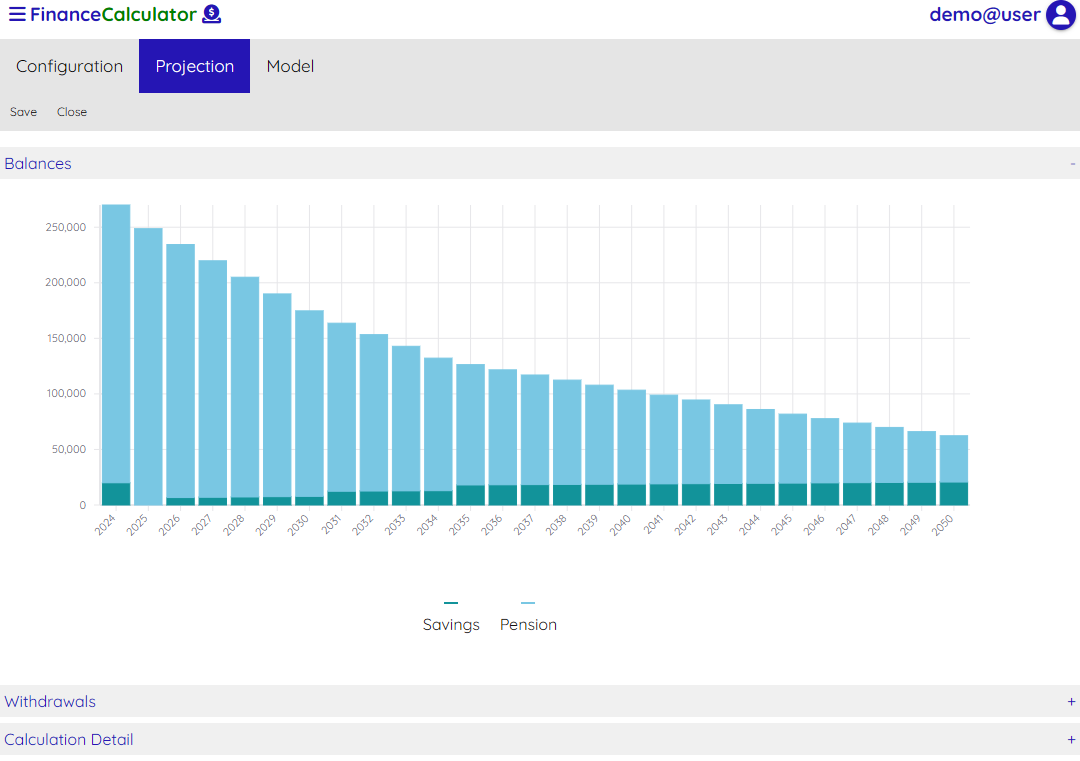

Scenario Projection

To see whether your scenario is able to support your desired withdrawals you can look at the Projection tab. This will give you a graph showing how your expected investment balances over time, using average return values for the investment types that you have chosen. In this case it appears that the scenario will succeed.

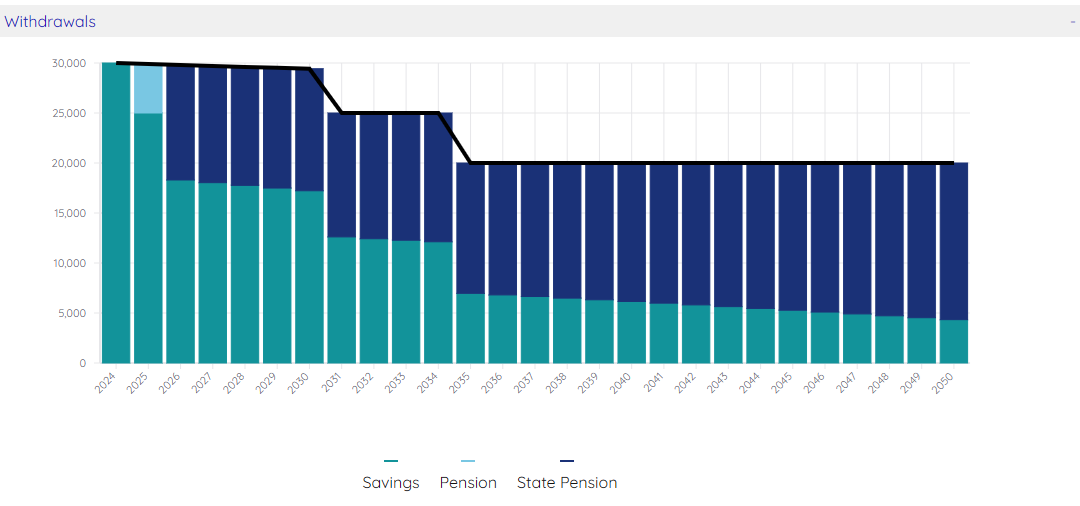

You can also click on ‘Withdrawals’ to see a breakdown of where money was withdrawn from. You’ll see that from 2026 the state pension kicks in, and that the desired level of withdrawal can be sustained to the end of the plan.

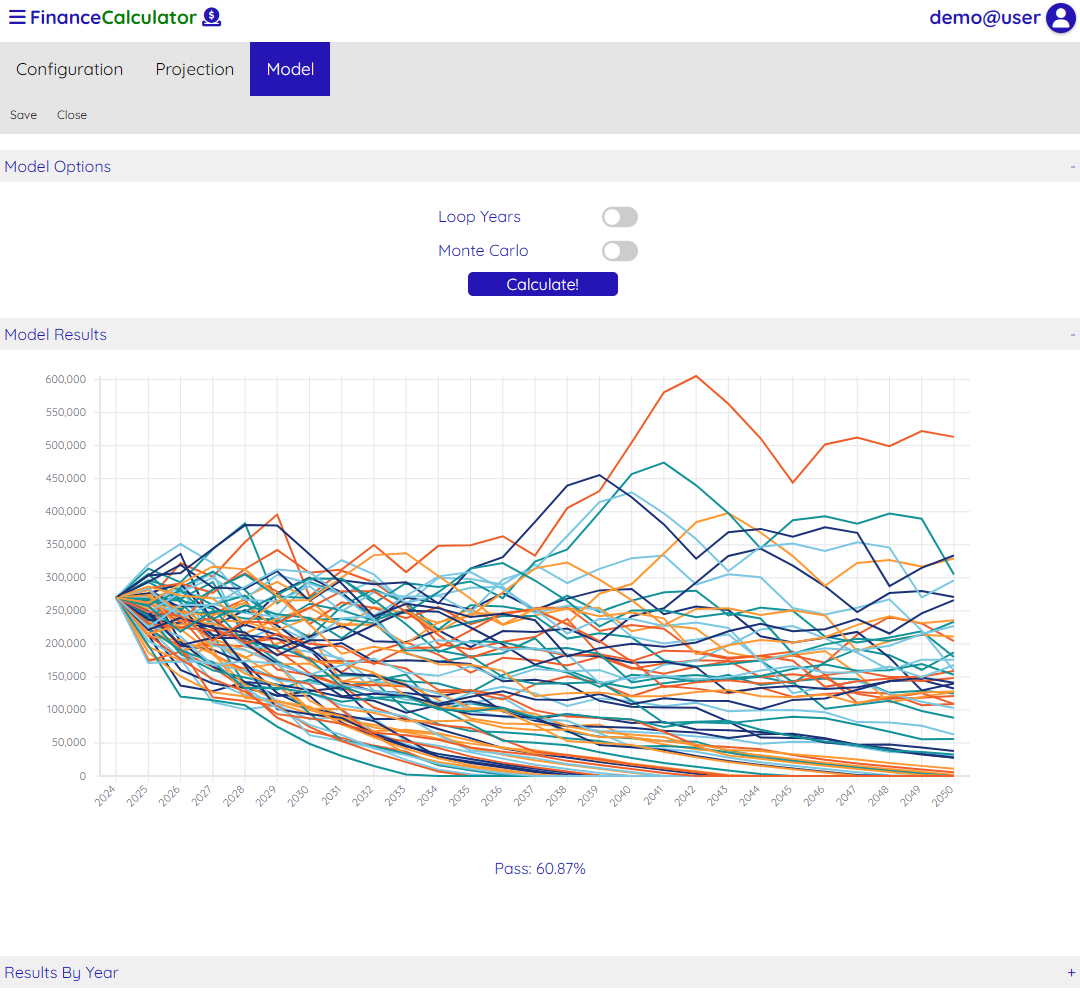

Scenario Modelling

Here you can run your scenario against either historic data or you can choose ‘Monte Carlo’ simulation. See the Modelling Guide for more information on how this works and how to use it.

The performance of your scenario varies a lot depending on how the stock market and bonds performed during the time that it is active, and the returns at the start of the scenario are very important. This is known as Sequencing Risk.

You can see that even though the Projection for this scenario makes it look like it will succeed, it would have actually succeeded just over 60% of the time using historic performance data. Once you have run your scenario through a model those results will be shown on the scenario selection page.