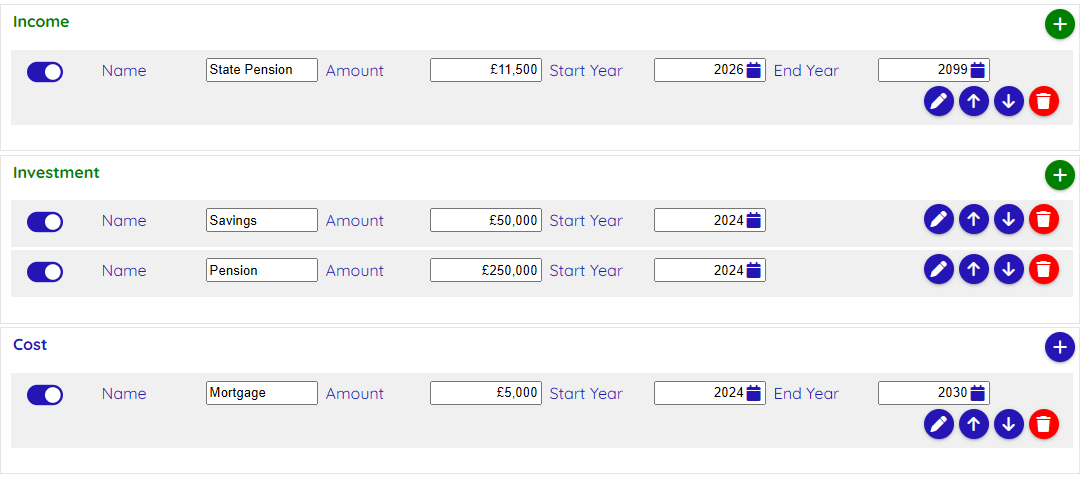

Incomes, Investments and Costs are all configured in a similar way, but relate to specific aspects of your scenario.

Incomes are for recurring amounts of money you will receive. They are for a known amount and are not subject to fluctuations in the stock market or bonds returns. Examples of these are:

- State pension

- Defined benefit pension (e.g. final salary pensions)

- Rental income for additional properties

Investments are for accounts which do not provide a regular income, but which you can draw down from. Examples of these are:

- Savings accounts

- ISAs

- Defined contribution pensions (e.g. private pension)

Costs are for recurring or one-off expenditure. Examples of these are:

- Mortgage payments

- Car payments

- Special holidays

- Gifts for children

Common Configuration Elements

Each configuration sections has a number of common elements:

- ‘+’ button – this will add an additional row to the section

- A toggle switch on the left side of each row – you can use this to disable a row so that it is not used in calculations

- A set of buttons on the right side of each row

- A ‘pencil’ button which will expand the row and show additional configuration

- An ‘up’ button to move the row up one

- A ‘down’ button to move the row down one

- A ‘trashcan’ to delete the row. You will always be asked to confirm this.

- Name

- Amount – the value at the ‘Start Year’

- Start Year – the year from which this will be included in the calculations

- End Year – the year up to which this will be included in the calculation. This is not relevant to investments.

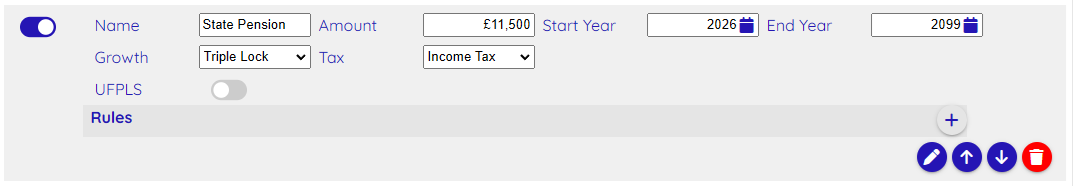

Income Additional Configuration

- Growth – set the amount that the income will change each year. The options available are:

- Flat – no change or -2% after inflation

- Inflation – rises with inflation so remains the same

- Triple Lock – the UK’s state pension increase which is assumed to be 1.5% over inflation

- Custom – set your own annual change percentage

- Tax – how is this income taxed?

- None – not tax is applied

- Income Tax – UK income tax is applied

- Inc. Tax & NI – UK income tax and national insurance contributions applied

- UFPLS – will you receive additional tax relief on this income? Only visible when Income Tax selected.

- Rules – see Rules documentation.

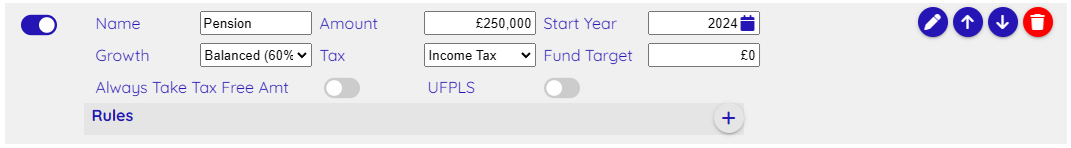

Investment Additional Configuration

- Growth – set the amount that the income will change each year. The options available are:

- Cash – no interest so -2% after inflation

- Savings – 1% over inflation

- Bonds – 1.2% over inflation

- Low (20% Equities) – 1.92% over inflation

- Mid (40% Equities) – 2.64% over inflation

- Balanced (60% Equities) – 3.36% over inflation

- Mid/High (80% Equities) – 4.08% over inflation

- 100% Equities – 4.8% over inflation

- Custom – set your own annual percentage change

- Tax – how is this income taxed?

- None – not tax is applied

- Income Tax – UK income tax is applied

- Fund Target – at the end of the year a ‘rebalancing’ happens where funds from other investments are used to top up an investment to its desired ‘fund target’ if its current balance is lower than that. For more detail see the Scenario Calculation guide.

- Always Take Tax Free Amt – do you always want to take funds up to the annual tax free amount? Only visible when Income Tax selected.

- UFPLS – will you receive additional tax relief on this income? Only visible when Income Tax selected.

- Rules – see Rules documentation.

Cost Additional Configuration

- Growth – set the amount that the income will change each year. The options available are:

- Single – this is a one off cost and when selected no End Year configuration will be shown

- Flat – no change or -2% after inflation

- Inflation – rises with inflation so remains the same

- Custom – set your own annual change percentage

The Significance of Order

The order of the rows is important as this affects the calculation. In general the calculation does the following:

- Take withdrawals and add them to any active costs to get total amount needed for the year

- Take all Income

- Working from the top row of investments and going down withdraw funds to reach the desired annual withdrawal

The order that investments are drawn down from can make a large impact on the success of the plan. This ordering, in conjunction with the ability to set Fund Targets allows for multi-pot strategies to help mitigate risk. More on this in the Scenario Calculations guide.

Estimated Investment Returns

The estimated stock and bonds returns have been determined from https://www.blackrock.com/institutions/en-gb/insights/charts/capital-market-assumptions